Minimum wage calculator after tax

You can use our Irish tax calculator to estimate your take-home salary after taxes. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

Build Your Future With A Firm That Has 85 Years Of Investing Experience.

. Get Started In Your Future. This calculator can determine overtime wages as well as calculate the total earnings. Ad Find A One-Stop Option That Fits Your Investment Strategy.

Minimum Wage Salary After Tax. This is equivalent to 289348 per month or 66773 per week. United States US Salary After Tax Calculator.

Get Started In Your Future. The money you take home after all taxes and contributions have been deductedAlso known as Net Income. These assume a 40-hour working week.

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Texas. See where that hard-earned money goes - Federal Income Tax Social Security and. National Minimum Wage and Living Wage calculator for workers.

But calculating your weekly take-home. Minimum Wage Salary After Tax. If you make 55000 a year living in the region of Texas USA you will be taxed 9076.

The money you take home after all taxes and contributions have been deductedThe average monthly net. Your average tax rate is. Your average tax rate is.

How Your Paycheck Works. Your employer withholds a 62 Social Security tax and a. That means that your net pay will be 37957 per year or 3163 per month.

The minimum wage in California means that a full-time worker can expect to earn the following sums as a minimum before tax. If you make 55000 a year living in the region of New York USA you will be taxed 11959. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Your average tax rate is. That means that your net pay will be 43041 per year or 3587 per month. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Your employer owes you past payments from the previous year because of underpayment. You must be at least 23 years old.

Earning The Adult Minimum Wage per year before tax in New Zealand your net take home pay will be 3472176 per year. Just type in your gross salary select how frequently youre paid and then press Calculate. That means that your net pay will be 45925 per year or 3827 per month.

Ad Find A One-Stop Option That Fits Your Investment Strategy. United States US Salary After Tax Calculator. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

This places US on the 4th place out of 72 countries in the. Build Your Future With A Firm That Has 85 Years Of Investing Experience.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Texas Paycheck Calculator Smartasset

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2022 Federal State Payroll Tax Rates For Employers

What Are Employer Taxes And Employee Taxes Gusto

Payroll Tax Engine Symmetry Tax Engine

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

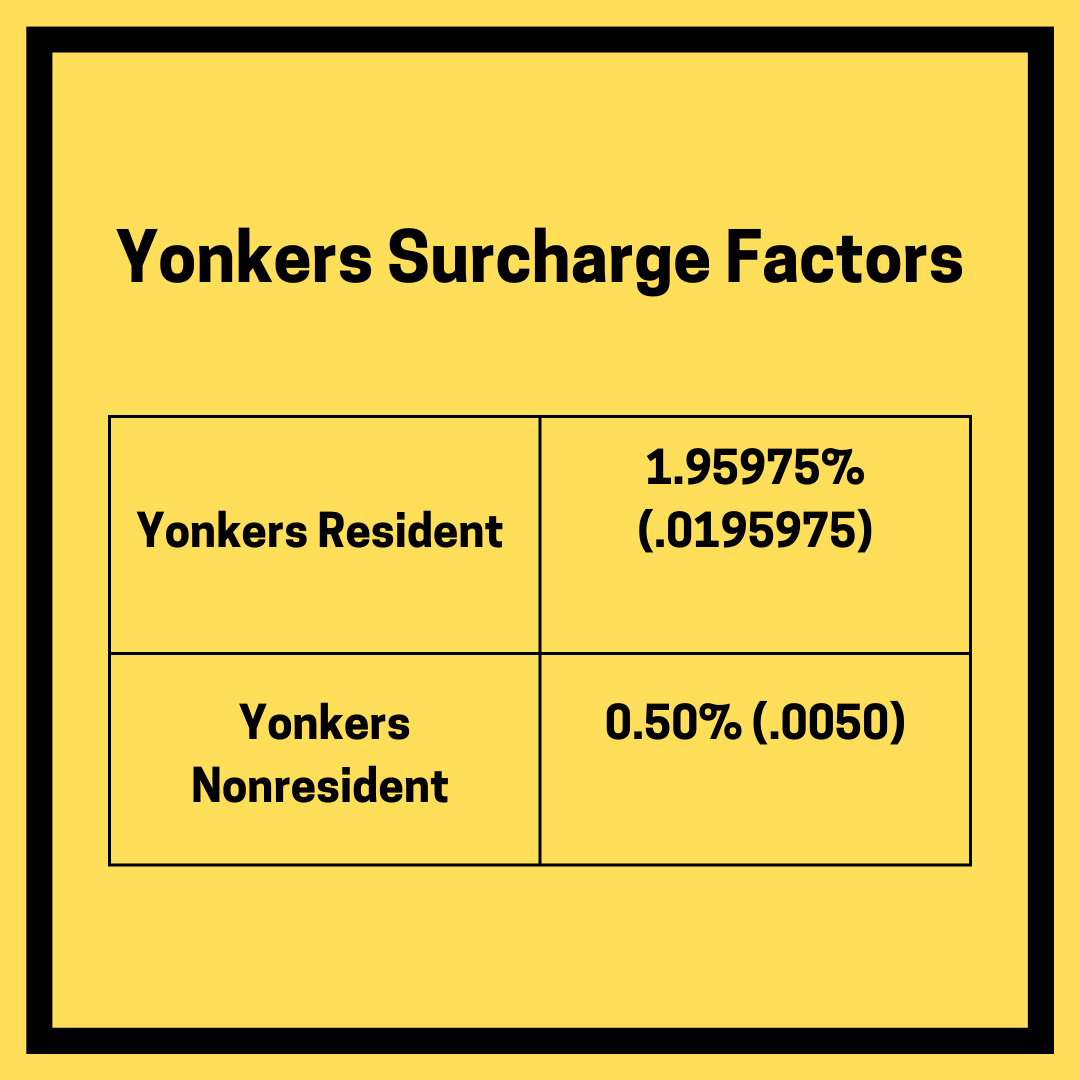

A Complete Guide To New York Payroll Taxes

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

New York Hourly Paycheck Calculator Gusto

How To Calculate Net Pay Step By Step Example

Federal Income Tax Calculator Atlantic Union Bank

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Tax Calculator For Employers Gusto